Is Allmax Nutrition Available in Canada? Complete Buyer’s Guide

Is Allmax Nutrition Available in Canada? If you’ve been training in the gym, exploring sports supplements, or following fitness communities, chances are you’ve come across Allmax Nutrition. Many people ask the same question: “Is Allmax Nutrition available in Canada?” The answer is a resounding yes. Not only is Allmax Nutrition available in Canada—it is actually a Canadian-born company with a strong reputation both domestically and internationally.

In this comprehensive guide, we’ll cover everything you need to know about Allmax Nutrition in Canada: the brand’s history, why it is trusted, where to buy it, popular products, real customer insights, and expert tips to help you make the best purchase decisions. By the end of this article, you’ll know exactly why Allmax has become one of Canada’s most respected supplement brands.

About Allmax Nutrition

Allmax Nutrition was founded in the late 1990s in Ontario, Canada. Since its beginnings, the brand has built its reputation on quality, purity, and performance-driven nutrition. The philosophy behind Allmax is simple: supplements should deliver what they promise, be tested for safety, and be manufactured under the strictest standards.

The company operates under pharmaceutical-grade Good Manufacturing Practices (cGMP) and subjects its supplements to third-party lab testing. This ensures that what you see on the label is exactly what you get in the product—no fillers, no underdosed ingredients, and no misleading claims.

Today, Allmax Nutrition is recognized as a leading Canadian supplement brand with a growing global presence. From professional athletes to weekend warriors, thousands of Canadians trust Allmax to support their performance, recovery, and everyday health.

Is Allmax Nutrition Available in Canada?

Yes, Allmax Nutrition is widely available across Canada. In fact, being a Canadian brand means its products are even easier to access domestically than in many other countries. Whether you prefer shopping in-store or online, you’ll have no trouble finding Allmax supplements.

The brand is stocked by:

- Major supplement chains such as GNC and Popeye’s Supplements.

- Big-box retailers including Walmart, which often lists popular Allmax products online.

- Specialized health and nutrition websites like National Nutrition, SupplementScanada, Vitamart, and Optimize Nutrition.

- The official Canadian Allmax website, which ships directly to Canadian customers.

This wide distribution means Canadians can compare prices, flavors, and product sizes with ease, ensuring access to fresh and authentic stock.

Why Canadian Buyers Trust Allmax

There are several reasons Canadians consistently choose Allmax Nutrition over competitors:

- Canadian Heritage

Allmax is proud to be Canadian-owned and operated. This resonates with buyers who want to support local businesses while benefiting from products that are designed and tested with Canadian regulations in mind. - Stringent Manufacturing Standards

Allmax products are produced in cGMP-certified facilities, which follow pharmaceutical-grade guidelines. Every batch is tested for quality, purity, and potency. - Health Canada Compliance

Supplements in Canada must comply with strict rules set by Health Canada. Products often carry a Natural Product Number (NPN), which guarantees safety, accuracy of labeling, and quality standards. - Transparency and Testing

Each formula is tested and verified. Customers trust Allmax because the company avoids the “proprietary blends” common in the supplement industry and instead lists exact ingredient amounts. - Positive Community Feedback

Across Canadian fitness forums and Reddit communities, Allmax is consistently praised for its creatine, whey protein isolates, and BCAAs. Many users specifically mention that Allmax is their “go-to Canadian brand.”

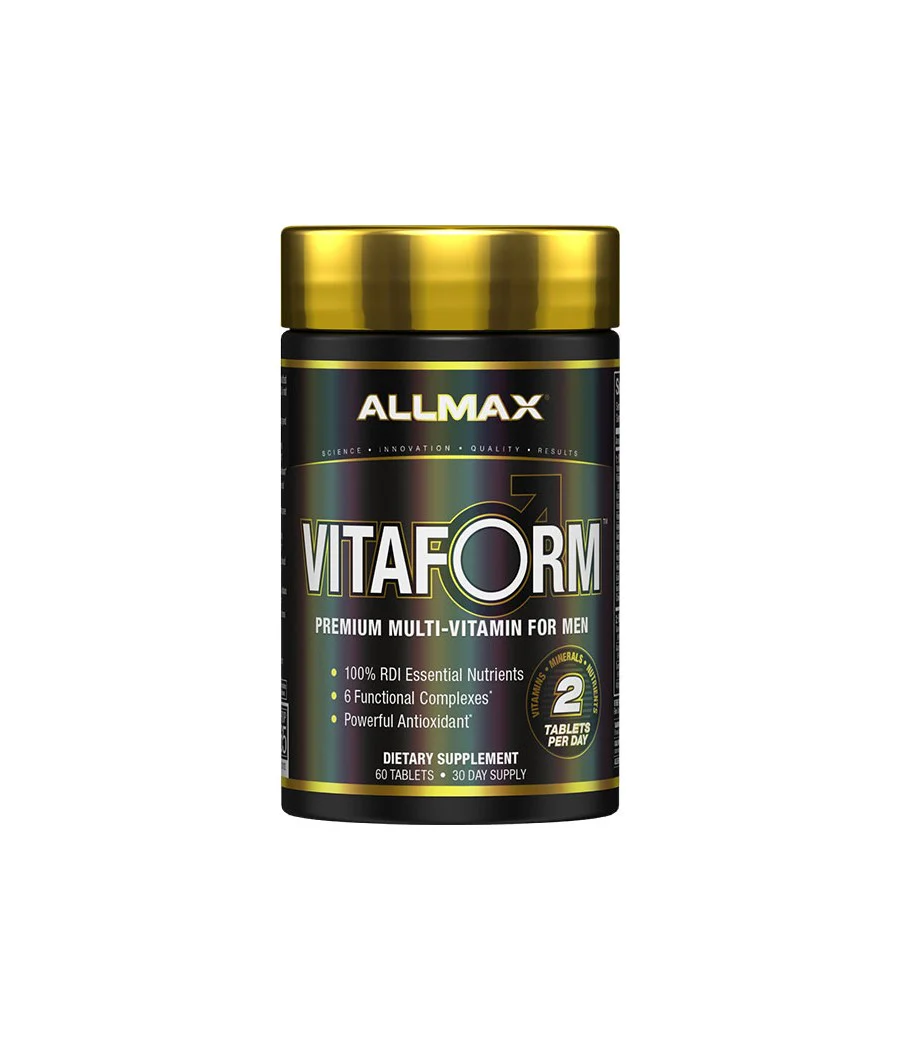

Popular Allmax Products Available in Canada

Allmax Nutrition offers a wide range of supplements, but a few have earned legendary status among Canadian fitness enthusiasts. Here’s a closer look:

1. Isoflex® Whey Protein Isolate

Arguably the brand’s flagship product, Isoflex is a pure whey protein isolate with very low sugar, carbs, and fat. It’s ideal for athletes who want maximum protein with minimal extras. Isoflex is also available in multiple flavors, from classic chocolate to fruity varieties.

2. IsoNatural™ Whey Protein Isolate

For those who prefer a cleaner option with no artificial flavors, IsoNatural is made with natural ingredients, is virtually lactose-free, and has no added sugar. It’s popular among health-conscious Canadians who want purity without compromising taste.

3. AllWhey Classic

A more affordable protein blend that combines whey protein concentrate and isolate. It’s perfect for everyday use and is commonly available in bulk tubs across Canada.

4. Aminocore® BCAA

This product is designed for muscle recovery, featuring a scientifically validated 8:1:1 ratio of branched-chain amino acids. Aminocore is popular among weightlifters and endurance athletes who need help with recovery and performance.

5. Creatine Monohydrate

One of the most popular creatines in Canada, Allmax Creatine is micronized for better absorption and sold in large value tubs. It’s praised for being affordable, reliable, and lab-tested for purity.

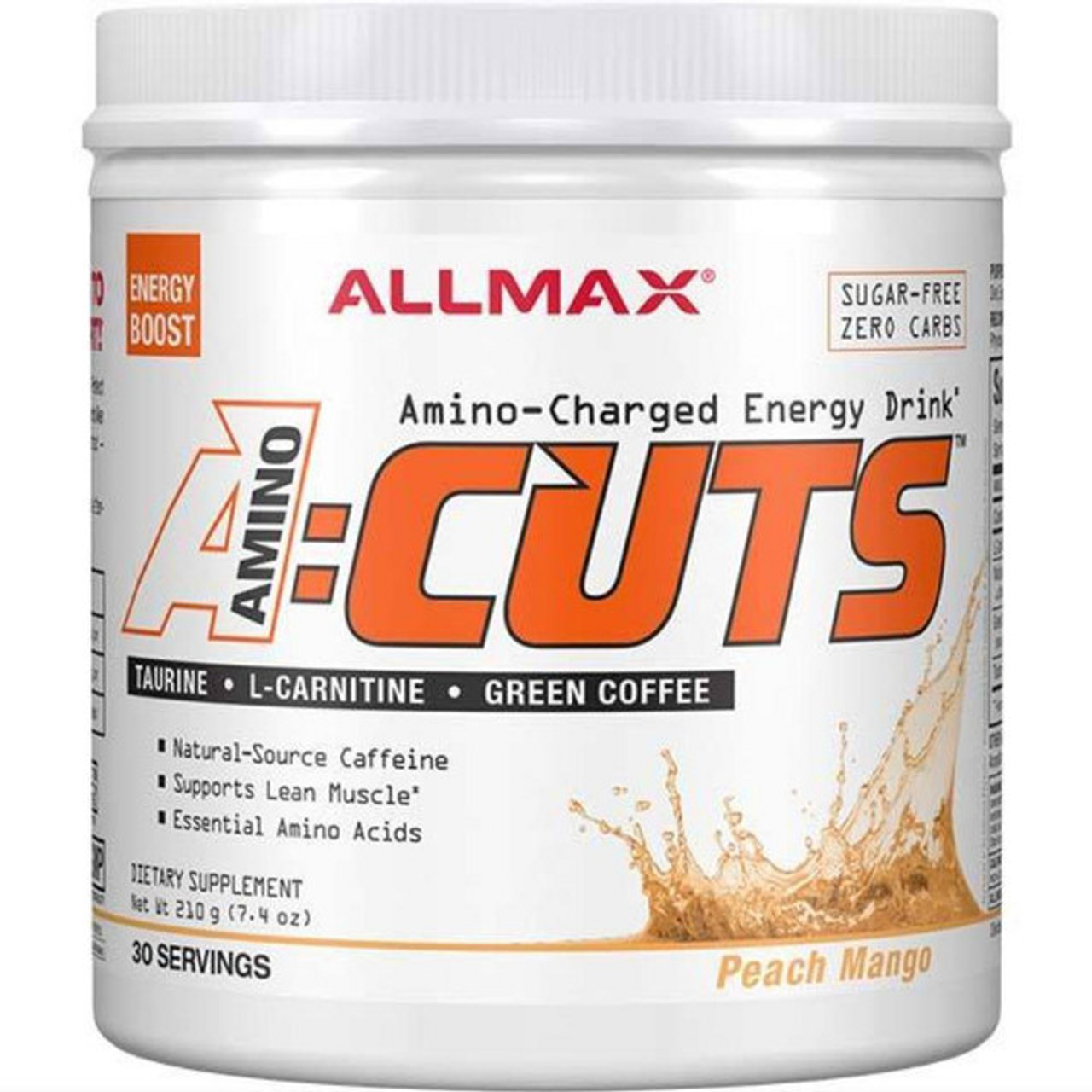

6. A:Cuts Amino Energy Drink Mix

A hybrid product that combines amino acids with natural caffeine for clean energy. A:Cuts is widely used as a pre-workout, fat-loss support, or even as a healthier alternative to energy drinks.

7. Specialty Products

Allmax also produces a variety of other supplements, including Carbion+ for endurance, CytoGreens for superfood nutrition, and Citrulline Malate for pumps and performance.

Where to Buy Allmax Nutrition in Canada

Here are the main ways Canadians can purchase Allmax products:

- Supplement Chains: Stores like GNC and Popeye’s Supplements always stock Allmax protein powders, creatine, and BCAAs.

- Big-Box Retailers: Walmart Canada lists many Allmax products online, sometimes at lower prices or in bundle deals.

- Online Health Stores: Canadian sites such as National Nutrition, Vitamart, and SupplementScanada carry the full line of Allmax supplements with detailed product descriptions.

- Official Brand Website: Canadians can buy directly from Allmax’s official site for guaranteed authenticity.

How Allmax Fits Within the Canadian Supplement Regulatory Landscape

One of Allmax Nutrition’s strongest yet often underappreciated advantages is how seamlessly it operates within Canada’s uniquely strict supplement regulatory environment. Unlike some international brands that reformulate or limit product availability for the Canadian market, Allmax develops many of its formulas with Health Canada compliance as a baseline rather than an afterthought. This results in fewer reformulations, clearer labeling, and consistent ingredient transparency across product lines. For Canadian consumers, this means reduced risk of banned substances, mislabeled dosages, or regulatory recalls—issues that have historically affected imported supplements. This regulatory alignment reinforces Allmax’s reputation as a “low-risk, high-trust” brand for both competitive athletes and everyday gym-goers.

Who Should Choose Allmax—and Who Might Look Elsewhere

Allmax Nutrition is particularly well-suited for athletes and consumers who prioritize ingredient accuracy, clinical dosing, and long-term reliability over trend-driven formulations. Strength athletes, bodybuilders, and recreational lifters benefit most from Allmax’s proteins, creatine, and amino-based recovery products, where consistency and purity matter more than stimulants or novelty ingredients. However, consumers seeking heavily stim-loaded pre-workouts, exotic nootropics, or aggressively marketed “hardcore” blends may find Allmax’s approach more conservative. This is not a weakness but a strategic positioning: Allmax focuses on fundamentals done correctly. For Canadians who value evidence-based supplementation over hype, this positioning is precisely what makes the brand dependable year after year.

Real-World Insights from Canadian Users

Canadian fitness communities are vocal about their experiences with Allmax:

- Some users swear by Allmax Creatine, calling it their “go-to” choice for strength and recovery.

- Others praise Isoflex, often mentioning that it mixes well, tastes great, and digests easily.

- On Reddit, many users highlight the fact that Allmax is Canadian-made, which builds additional trust compared to imported supplement brands.

This community feedback adds credibility and helps new buyers feel confident in their purchase.

Tips for Canadian Shoppers

Before buying Allmax in Canada, here are a few useful tips:

- Check for Authenticity

Always buy from recognized retailers or directly from the Allmax site. Avoid third-party sellers that may not guarantee freshness or authenticity. - Look for NPN Numbers

Many Allmax products are licensed by Health Canada. The NPN ensures safety and compliance. - Compare Prices

Prices can vary across retailers. Supplement stores often run promotions, while big-box chains may offer bundles or bulk discounts. - Watch for Free Shipping Deals

Many Canadian supplement websites offer free shipping on orders above a certain threshold, usually between $50–$80. - Read Reviews

Customer reviews are helpful for choosing flavors. For example, Isoflex has dozens of flavor options, but Canadians often rate Chocolate Peanut Butter and Birthday Cake as favorites.

Conclusion

So, is Allmax Nutrition available in Canada? Yes—absolutely. In fact, it’s one of the country’s most trusted supplement brands, with deep roots in Canadian manufacturing and a reputation for purity and effectiveness. From whey protein isolates like Isoflex and IsoNatural to Aminocore BCAAs and creatine, Allmax offers a complete lineup for every fitness goal.

With availability through major supplement chains, big-box retailers, online health stores, and the official Canadian website, Canadians have no shortage of options. Add in the brand’s reputation for quality and Health Canada compliance, and it’s easy to see why Allmax continues to dominate the Canadian supplement scene.

If you’re looking for supplements that are Canadian-made, scientifically backed, and widely trusted, Allmax Nutrition should be at the top of your list.